The Monetary History of the USA. Part 2: Between Silver and Gold

The economic boom after the American Civil War

After the civil war, the North experienced a tremendous economic boom while an economic depression prevailed in the southern states. The liberation of almost 3.5 million slaves did not only result in an enormous loss of property for the farmers in the South, but also deprived the cotton economy of its traditional foundation. In the North, on the other hand, the scarcity of human resources during the war had favoured the industrialisation of the agricultural sector. The railway network had been expanded here in order to facilitate supplies to the front line, while the existing network of the South had been destroyed systematically.

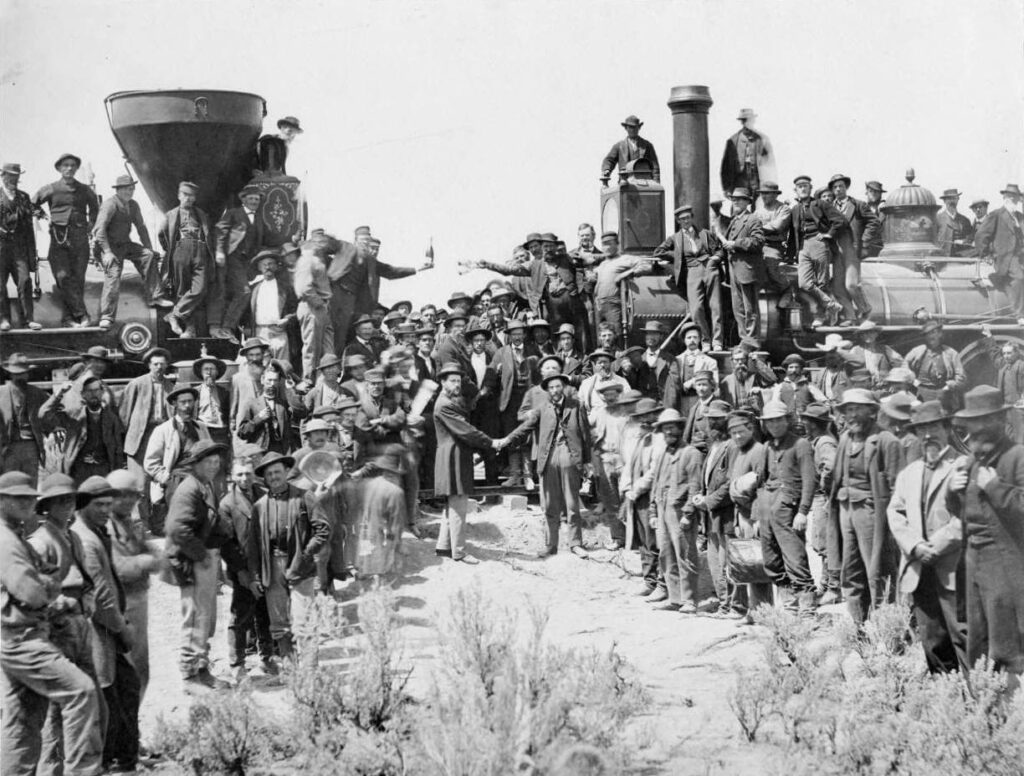

The construction teams of the Central Pacific and the Union Pacific railroads meet and thus complete the transcontinental railroad between the Atlantic and the Pacific Ocean. National Archives and Records Administration. NAID 594940.

In the years from 1860 to 1870, almost all economic sectors and states of the USA experienced a breath-taking upturn – apart from the South. The USA did not only become the world’s largest wheat exporter but also the most important producer of iron and steel worldwide.

During those years, successful economic pioneers laid the foundations for huge fortunes; men as John D. Rockefeller, Cornelius Vanderbilt or Cyrus H. McCormick outdid most politicians of their time in terms of power and influence. Admired and hated, they shaped the performance principle of the American society and became models for the American dream of the self-made man.

The influence of business magnates on politicians helped corruption and profiteering flourish. At the beginning of the 70s, one scandal after the other shook the country and exposed the profit-seeking of wide circles of businessmen and politicians. As from 1873, the overheated economic climate began to cause eruptions. What followed was a series of bankruptcies that led to a severe economic crisis. The results were a collapse of prices and a high rise of unemployment; it was not until 1878 that the economy of the northern and southern states began to recover.

After the American Civil War, the value of greenbacks plummeted. Picture: National Numismatic Collection, National Museum of American History.

Economic expansion and economic crisis: Numismatics

In the years after the civil war, the American federal authorities were faced with a problem. In order to cover the huge war costs, large amounts of paper money had been printed during the war – among others the “greenbacks”, the banknotes of the northern states. The name refers to the counterfeit-proof green colour used to print the note’s reverse, while the obverse is printed in black.

Greenbacks were not covered by precious metal reserves, and the more banknotes in circulation, the lower their value compared to silver and gold dollars: In 1865, a greenback dollar’s value in gold was only 49 cents. And when it came to the repayment of war debts after the war, obviously, this question arose immediately: Should the debts be settled in dollars made of precious metals or in paper money? For the government, a repayment in silver or gold dollars was out of the question because, thanks to the low exchange rate of the paper dollar, its debts were worth more than 50 percent less in paper money than in gold dollars.

A repayment in coins would have been difficult anyway: At the end of the 1860s, there were barely any coins left in circulation; during the war, they had disappeared into the citizens’ saving boxes because they considered them to be relatively secure assets. Therefore, there was a severe shortage of metal money – all the more because the Spanish pesos and all other foreign circulation coins had been officially withdrawn from circulation in 1857.

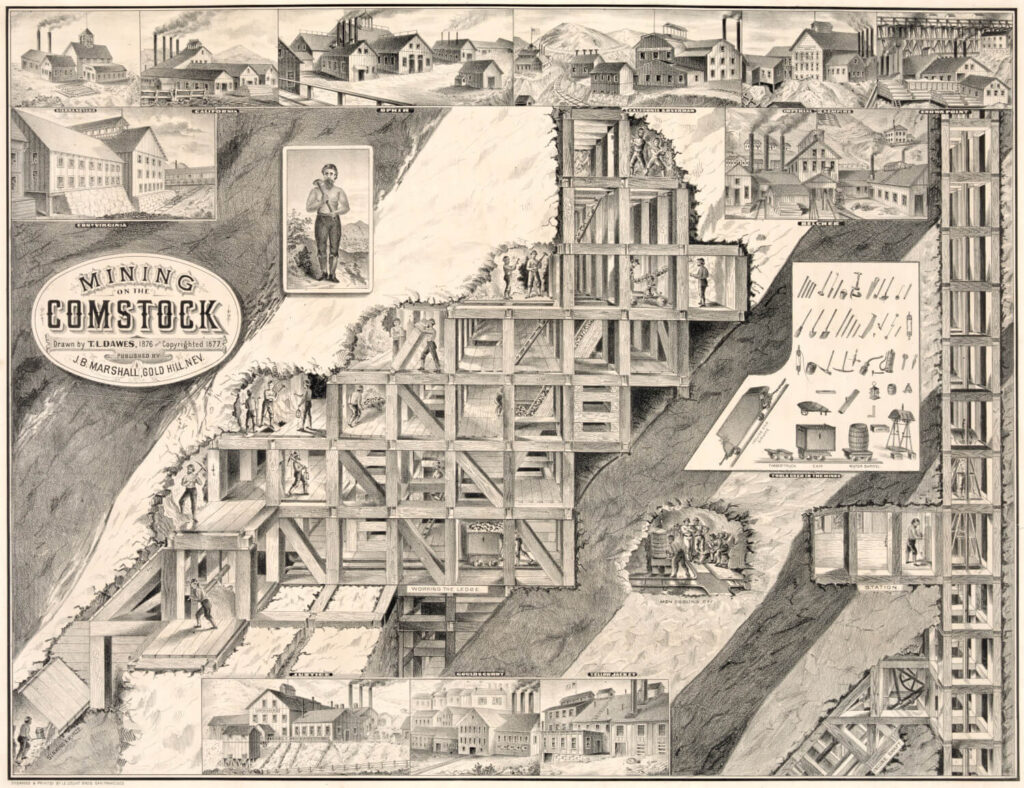

Theoretically, there were enough silver deposits in the country to overcome the shortage of coins; but the Congress was afraid that new silver coins would also disappear from circulation immediately and be exchanged for paper money, which was abundant in circulation. Therefore, the silver of the American silver mine owners was not used. Since they could not sell their goods in the USA, they threw the silver onto the world market: Huge quantities were exported to Europe at dumping prices causing the European silver prices to plummet. In the following years, most European countries moved their currencies from the silver to the gold standard: From then on, currency reserves would be deposited in gold and no longer in silver.

In 1873, the American silver mine owners came up with the idea of producing silver coins for the booming trade with Asia – until then, mainly Spanish and South American pesos had been used in this trade market. In order to beat the competition, the Americans made their trade dollars heavier than the pesos and increased the silver content, which was indicated on the coin: “420 GRAINS, 900 Fine” means that this coin has a total weight of 27.22 grams and contains almost 25 grams of pure silver.

The end of private minting

Due to a reduction of the paper money and the economic upturn the USA experienced after the civil war, at the end of the 1870s, the paper dollar was again worth exactly as much as the gold dollar. But as mentioned, the value of the silver dollar had declined in the meantime: From 1876 onwards, the market value of silver was so low that it became profitable for American silver mine owners to produce the heavy trade dollars also for the domestic market – and that is exactly what they did. In the following years, their trade dollars flooded the USA.

This increase in money supply did not match the concept of the government, which had successfully reduced the amount of money in circulation during the previous years. Therefore, the Congress stopped the private minting of silver dollars – until then, everyone in the USA had been entitled to mint his or her own coins.

However, various groups did not agree with the prohibition of private minting – and not only the silver mine owners were among them. America’s debtors protested as well because they had hoped to be able to settle their debts more easily by using silver dollars, which declined in their value compared to the gold and paper dollars. A “silver party” came into being, which took up the cause of the private minting of silver coins.

The question about the right American monetary policy caused a lot of debates in the following years. The Establishment – the upper class and thus the creditors – insisted on controlling the amount of money in circulation and on a hard gold currency. The debtors on the other hand – mainly farmers but also workers – wanted a silver dollar with a lower value, which also reduced the value of their debts.

In order to partially satisfy the silver lobby, the US Congress required the US government to purchase at least 2 million dollars’ worth of silver each month and to coin it into silver dollars. After a short period of time, the so-called Morgan dollars were available in such large quantities that they piled up in the Treasury vaults because most Americans already preferred using the practical paper money for their daily businesses.

The enormous purchases of silver rapidly ate up the national money reserves. Furthermore, the decreasing value of silver made the precious gold coins disappear from circulation – people saved them while they spent huge amounts of silver coins, which had a lower bullion value. In 1890, 90 percent of the customs revenues consisted of gold coins; two years later this number shrank to 4 percent.

The depicted half eagle, the golden 5 dollar piece, was very popular among Americans – it was the coin that grandparents put in their grandchildren’s Christmas stockings and birthday presents. At the end of the 19th century, 5 dollars still had a considerable value: One half eagle had the same purchasing power as a modern 100 euro note.

In the 1893 recession, the silver dollar dropped in value to 53 cents compared to the gold dollar. In that year, the threat of a devaluation of the dollar led to hasty share sales and, as a result, to a severe economic crisis. The late 1890s of the USA were characterized by depression and uncertainty.

In the presidential election campaign of 1896, the question of whether to use the silver or the gold standard as the basis of the American monetary system was the top campaign issue. The victory of a pro-gold candidate finally cleared the way for the gold standard. In 1900, the gold dollar was declared the only standard unit of account. The silver dollar remained in circulation but lost more and more ground until 1935, when its minting was eventually stopped for a quarter of a century.

Becoming a world power

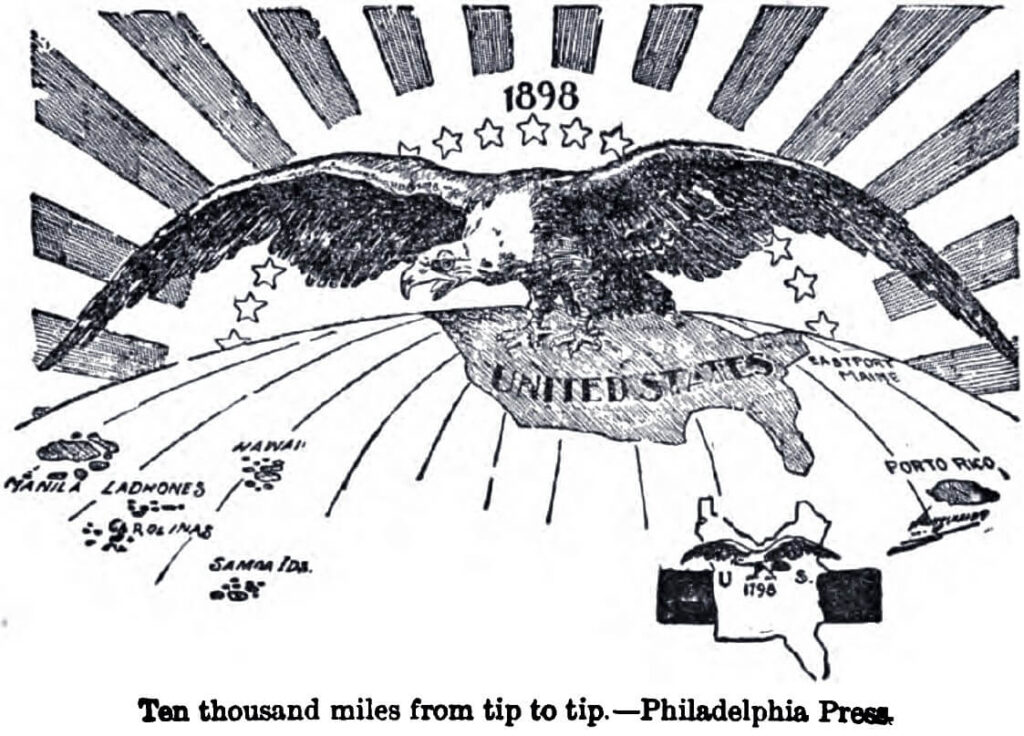

At the end of the 19th century, the last native Americans were wiped out or deported into reservations, the expansion to the west was completed and the time of frontiers was over – the American continent was fully developed. Now, the United States could focus on the matters of foreign policy. In 1898, the USA provoked a war with Spain, which ended in the defeat of the latter. In the course of this war, the USA occupied Cuba and annexed Puerto Rico and Hawaii; the peace treaty also forced Spain to cede the Philippines and the island Guam to the victors. Thus, the Caribbean and Pacific regions belonged mainly to the territory of the USA.

Even the small Latin American countries experienced the power of the United States: In order to strengthen the military importance of the USA in the Pacific, President Theodore Roosevelt (1901-1909) envisaged building the Panama Canal. But Panama belonged to Colombia, and Colombia refused firmly to have the canal zone controlled by the USA. Therefore, Roosevelt orchestrated a revolution of the Panamanian population in Colombia that led to the violent secession of Panama. The new republic was immediately recognised by the USA – however, on terms that made Panama an American protectorate.

In the following years, more Latin American countries became politically and economically dependent on the USA. The “Dollar Imperialism” completed what had been achieved by wars and political pressure. North American companies started to invest abroad, North American banks granted loans and thus also gained substantial economic and political influence outside of the United States.

This increasingly applied to Europe as well. The First World War (1914-1918) brought prosperity to the American economy: The steel, ammunition and shipbuilding industries were booming, and also the economic branches that were not directly linked to war, such as agriculture, benefited from the great war. Already one year after the start of the war, the USA and the Allies were economically intertwined in such a way that a dissolution of these relations would have led to a financial disaster of the United States and the defeat of France and Great Britain.

In the next part you will discover the consequences of the Black Friday on the American and the world economy.

You can find all parts of the series here.