Royal Dutch Mint and Osborne Coinage Join the Heimerle + Meule Group

With the acquisition of Royal United Mint, the Heimerle + Meule Group is once again making a statement and underlining its ambitions in the global coin business.

As part of the Belgian Heylen Group, the parent company Royal United Mint is the world’s second largest private industrial holding company in the production of coins used for money. It includes well-known and renowned companies such as the Royal Dutch Mint, the American Osborne Coinage, as well as the Belgian companies Tools & Dies, Mauquoy Token Company and Royal Blanking.

“Since the acquisition, we have made the Royal United Mint Group a globally significant and profitable provider of official monetary coins, collector and investment coins and tokens. We are delighted to have found the ideal new shareholder in the Heimerle + Meule Group, which will continue this successful development,” says Vincent Van Hecke, CEO of Royal United Mint, who has acquired the entire token business through a spin-off, including the Belgian companies VistaMint, Mauquoy Token, Royal Blanking and National Tokens, and will continue to operate them independently.

The Royal Dutch Mint, one of the oldest mints in the world based in Houten, has been producing Dutch coins since 1567 and has developed into one of the largest coin manufacturers in Europe. It stands out in particular for its reliability, innovation, quality, creativity and sustainability and has already produced official coins used for payment for more than 60 national banks. Since coins often have a cultural or historical background, the leading mint manufacturer produces not only circulation and investment coins made of precious metals, but also popular commemorative coins, medals and tokens that are coveted by many collectors. As part of the Heimerle + Meule Group, the expansion of the capacities of the Royal Dutch Mint, which has already been initiated, will be further strengthened, and thus offers the company the prerequisite for continuous growth and to lead the way in serving the national and international market with coin products.

Part of the acquisition is the company Dutch Value Logistics, which uses its optimised logistics service to ensure the storage, packaging and shipping of products for its end customers.

The acquired Belgian company, Tools & Dies, specialises in customer-specific engineering services and the manufacture of complex punching, bending and embossing tools.

Osborne Coinage was founded in 1835, making it the oldest private mint in the USA. The long-standing American company based in Cincinnati, Ohio, has become a specialist in the production of coins and medals. Osborne Coinage also produces blanks for other mints as well as commemorative and circulation coins for central banks and collectors. Within the Heimerle + Meule Group, the company will continue to grow, particularly in the area of precious metal coins.

“The acquisition of Royal United Mint and its subsidiaries, in particular Royal Dutch Mint and Osborne Coinage, represents a total stroke of luck for the Heimerle + Meule Group in many respects: we will continue to expand in the lucrative growth market for collector coins and see significant synergy potential through vertical integration. In addition, we will be able to penetrate new markets geographically speaking and, by covering the entire value chain from recycling to the finished packaged product, we will be able to present ourselves to our customers as a full-service provider,” says Thomas Frey, CEO of the Heimerle + Meule Group.

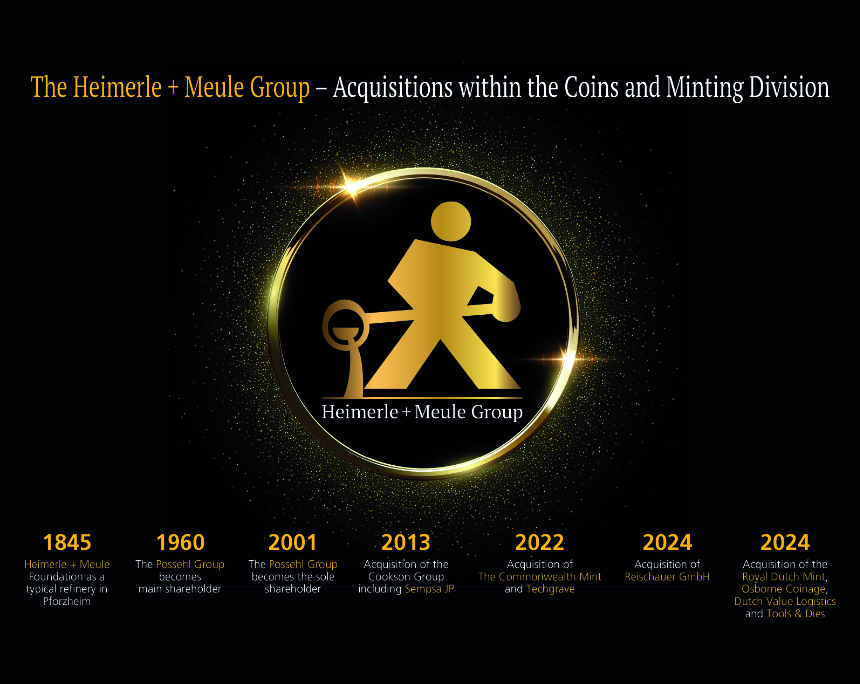

The Heimerle + Meule Group, which represents the precious metal processing division within the Lübeck-based Possehl Group, is already one of the most important market players in the precious metal sector. With the takeover of the Cookson Group in 2013, all the shares of Sempsa JP in Madrid were acquired among others, thus laying the foundation for entering the coin business. Since then, Sempsa JP has developed into one of Europe’s leading producers of precious metal coin blanks and has created the basis for strategically expanding the coin business along the value chain with state-of-the-art equipment. In addition, the majority stake in the British Commonwealth Mint was acquired in 2022 and another internationally renowned company in the coin industry was acquired with the acquisition of Reischauer GmbH at the beginning of 2024. The latest acquisition of the Royal United Mint with the two long-standing companies of the Royal Dutch Mint and Osborne Coinage is a further milestone for the Heimerle + Meule Group on its path to becoming a global key player in the coin business and thus underscores the long-term buy-and-build process.

“Thanks to internal and external growth, the Heimerle + Meule Group has steadily developed into an essential pillar within the Possehl Group. As the business model of the Heimerle + Meule Group reacts anti-cyclically to economic developments in many facets, it forms an ideal internal risk balance for us and thus a core element of our Group strategy,” says Dr Joachim Brenk, CEO of Possehl.