Interview: Are Modern Collector Coins a Sensible Investment?

It is becoming increasingly popular to buy coins as a form of investment, but this can be risky if the buyer lacks the necessary expertise. We spoke to someone who really knows their stuff: Dirk Wasserthal, Managing Director of RareCoin.Store and expert in rarities of modern numismatics, tells us what to look out for.

CoinsWeekly: Mr Wasserthal, you specialize in modern collector coins made from gold. How did you find your way into this field?

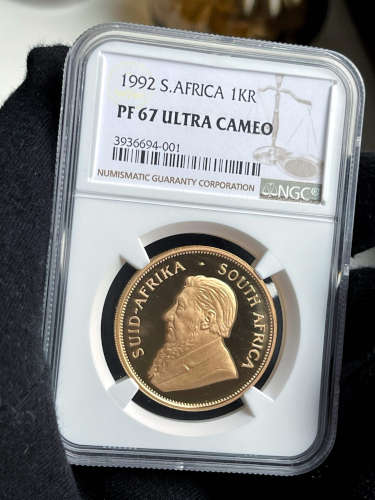

Dirk Wasserthal: As with any specialism, the key is to engage with a subject continuously and passionately for many years. I caught the collecting bug as a child in the 1980s. It started with postage stamps. I was fascinated by the history and art depicted on them. Over time, I began to develop an interest in coins, especially silver coins that my parents had collected, such as the issue commemorating the 1972 Olympic Games in Munich, and other German silver coins. I was drawn to their beauty and value and I started learning more about coins and collecting them. In the late 1990s, I finally started collecting my first gold coins. I was particularly taken by the Krugerrand. That was one of the first gold coins I bought, and it was then that I realised the potential held by modern coins.

Dirk Wasserthal is Managing Director of RareCoin.Store and expert in rarities of modern numismatics. Photo: RareCoin.Store.

As the years went by, I expanded the focus of my collection to include rare coins from Central and South America, as well as from Africa. These regions have a rich history and culture, and this is reflected in their coinage. The variety of motifs and the limited availability of some of these coins made them especially fascinating to me.

Over the years, I was able to broaden my knowledge of modern gold collector coins. Today, I am proud to be able to share my expertise and passion with other collectors and to help them with selecting and buying high-quality collector coins.

CoinsWeekly: Do you have any favorite coins in your collection?

Dirk Wasserthal: As I mentioned earlier, I am very fond of proof Krugerrands from South Africa. But I have also collected many coins from Mexico, such as proof Libertad coins, as well as the famous 200-peso Bicentenario coin. My collection also includes gold “pattern” coins. These are coins that were never officially approved for release but produced in order to evaluate a proposed coin design. These are, in most cases, extremely rare, are difficult to obtain on the market and can be highly valuable.

I also essentially consider the products in our online shop as “my collection”, which I share with other collectors by inviting them to buy a piece for their own collection.

CoinsWeekly: Let’s get to the key question. In your eyes, are collector coins a sensible form of investment? What advantages do they have in comparison to other forms of investment?

Dirk Wasserthal: Yes, collector coins, and primarily those made from precious metals, can be an interesting and profitable form of investment. Rare coins have the potential to increase in value over time. They present a good opportunity for investors to diversify their investment portfolio, i.e. to spread the risk by investing in different asset classes and to generate potential returns from various sources. Unlike other forms of investment, such as shares or bonds, collector coins are physical assets. These are also known as “tangible assets”. This aspect is appealing to some investors because it means they actually get something tangible in return for their investment. Additionally, collector coins have an aesthetic value that appeals to many people, whether they buy coins as a hobby or as an investment – or both.

However, it’s important to highlight that there are a number of things to consider before investing in collector coins. The market for collector coins is not without its risks; it can be volatile and there is no guarantee that the coins will increase in value. Furthermore, investors should do some thorough research in order to learn about the condition, authenticity and value of the coin they want to buy. Before investing in collector coins, it’s a good idea to consult a specialist and consider what risks you are willing to take, as well as your investment objectives.

Investments in collector coins require patience, expertise and a long-term perspective. Photo: RareCoin.Store

CoinsWeekly: You’ve already given some valuable tips for those looking to invest in collector coins. What else should potential investors consider?

Dirk Wasserthal: First of all, please note that these are all general tips and should not be regarded as financial advice. As I said earlier, it is essential to do your homework and familiarize yourself with the market.

If you are unsure or don’t have the necessary expertise, seek some advice from an experienced coin dealer, numismatist or collectors’ association. They will be able to help you with valuing coins, checking their authenticity and understanding the market. Spread your investments by investing in different types of collector coins. Decide how much you are prepared to invest and how much risk you are willing to take. Make sure that your budget is realistic and that you carefully consider your financial options.

The quality of the coins is very important; perfectly preserved coins generally have a much higher collector’s value, so focus on quality rather than quantity. This also includes storing your coins carefully. Use protective sleeves, coin capsules or coin albums to prevent your coins from getting scratched or damaged, since any damage will lower their value.

Finally, think of your purchase of collector coins as a long-term investment rather than a short-term speculative opportunity. The value of collector coins can change over time and may be affected by exchange rate fluctuations. Be patient and keep your expectations realistic.

CoinsWeekly: You touched on the subject of expertise. Many investors are worried about counterfeit coins, or pieces whose market value may turn out to be much lower than they were initially told.

Dirk Wasserthal: That is certainly a risk. Buying collector coins without properly verifying their authenticity is a risky move. You should only buy gold coins from reputable, established dealers or mints. Do your research in advance and check the dealer’s reputation. Read customer reviews and testimonials to ensure that the dealer is trustworthy.

If the price of a gold coin seems too good to be true, it should set alarm bells ringing. Compare prices offered by different dealers and make sure that the price corresponds to the current price of gold and to the coin’s collector’s value.

Buying “graded” coins is also a sensible option that will help to put the investor’s mind at ease.

The grading process offers collectors and investors certainty, objectivity and marketability for their coins. With this Mexican Libertad, the holder ensures that the NGC certified condition is maintained in the highest grade MS70. Photo: RareCoin.Store.

CoinsWeekly: What is grading? And what benefits does it provide exactly?

Dirk Wasserthal: Grading is a process by which an independent, specialist certification company evaluates the condition and quality of a coin. The leading companies in this field are the Numismatic Guaranty Corporation (NGC) and the Professional Coin Grading Service (PCGS). The certification company guarantees the authenticity of a coin and grades its condition on a scale from 1 to 70. This provides you with an objective and quantifiable assessment of the coin’s condition, which is a decisive factor when it comes to its value. You can look up exactly what price this type of coin with this grade achieves. This grading process also takes care of the issue of careful storage, which I mentioned earlier, because the coins are placed into sealed plastic holders where they are protected from damage, thus ensuring that they retain their value. The guarantee is only valid if this seal remains intact, because otherwise someone could have replaced the coin with another. For that reason, graded coins are generally easier to resell.

CoinsWeekly: What kind of tools would you recommend to any beginners who want to start investing in modern collector coins?

Dirk Wasserthal: There is a range of tools available to help beginners navigate this field. There are coin catalogues, for one. These are tremendously useful as reference works on the history, specification and value of coins. The “Standard Catalog of World Coins” published by Krause Publications covers a wide range of coins from various countries. There is also “Gold Coins of the World” – also called “Friedberg”, after its author – a catalogue containing gold coins from all periods of history. If you are looking for more in-depth information on your specific field, you’ll be better off reading specialist literature rather than general overviews.

If you have any specific questions, your best bet is to ask a trusted coin dealer – or to venture into the world of online forums, where collectors can share their experiences and know-how. In these forums, you can ask questions, get advice from experienced collectors and share ideas with like-minded people. One example of a popular coin forum is “CoinTalk”. And if you’re looking for more opportunities to interact with fellow collectors, you can also join a numismatic society or a coin association. These organizations often hold informative events, talks and meetings, where you can learn from experienced collectors.

CoinsWeekly: Mr Wasserthal, thank you for this interview.