A Historic Unique Piece Offered for Shared Ownership – A Model for the Future?

by Sebastian Wieschowski

With an offer that is unprecedented in the numismatic landscape, the American company “Kagin’s” is for the first time enabling the acquisition of shares in a collector’s dream: interested collectors and investors can purchase one or more shares in a $100,000 gold certificate, held in private ownership, via a blockchain-based platform. In other words: they can own a small part of the highest denomination ever issued in US paper money.

Inhalt

The $100,000 gold certificate from 1934 was originally created during the Great Depression exclusively for transactions between members of the Federal Reserve banking system and was never intended for everyday circulation. Only a few examples of the approximately 42,000 notes printed at the time still exist today – all of them held in government institutions such as the Smithsonian Museum or the Bureau of Engraving and Printing. The piece now offered by Kagin’s is a so-called “Specimen” example, bearing the inscription “SPECIMEN NOT NEGOTIABLE”.

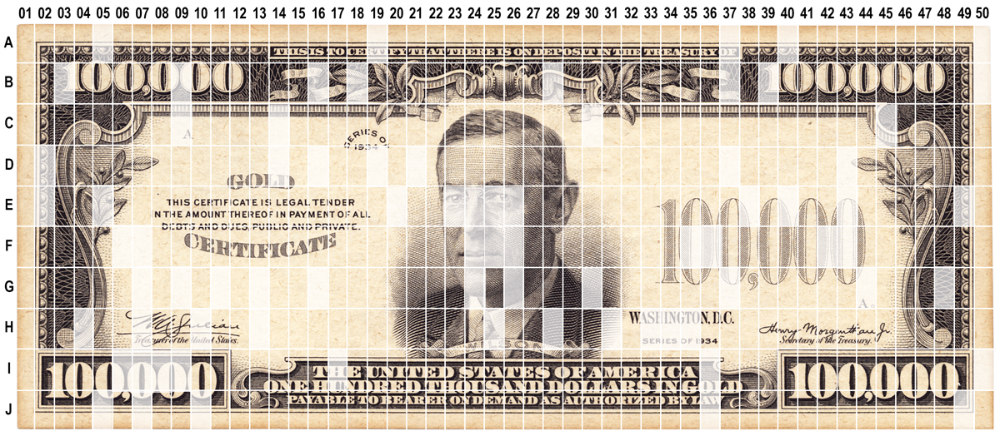

The innovative offer by the US coin dealer is based on the concept of “Fractional Ownership”: buyers acquire a digital representation of a physical share of the original document. Each unit corresponds to one five-hundredth (1/500) of the certificate. Transactions are secured through blockchain technology, which is intended to ensure transparent and tamper-proof ownership documentation. The physical artefacts remain stored in professionally monitored and climate-controlled vaults.

The Eye or Rather the Ear of Woodrow Wilson?

A special aspect of this (at first glance somewhat curious) offer is the possibility to select a specific segment of the certificate when purchasing five shares – for instance, the eye or the signature of Woodrow Wilson, whose portrait adorns the front of the banknote. Payment is possible via traditional methods as well as cryptocurrencies, and no special technical knowledge is required.

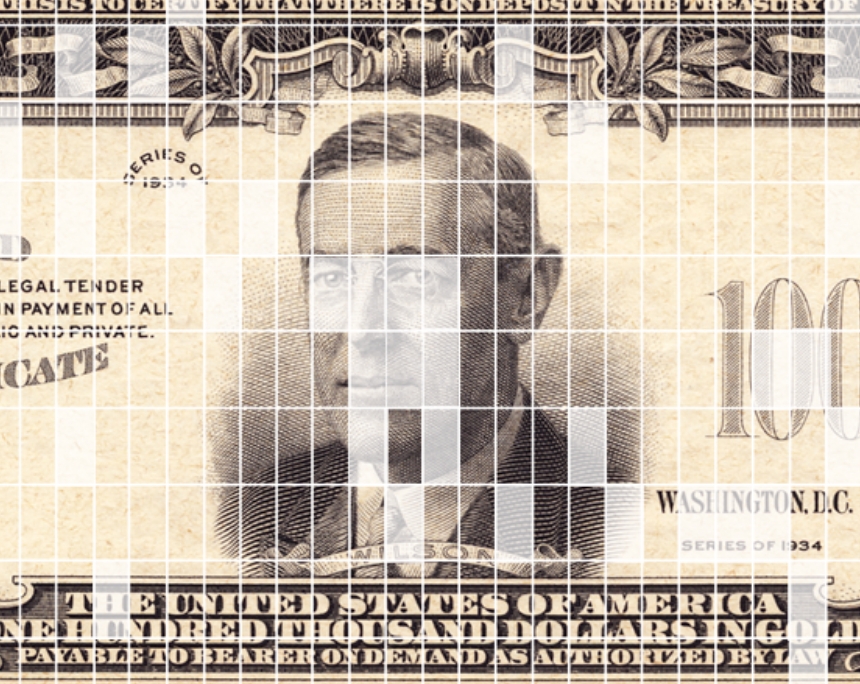

By the end of April 2025, individual pieces of the coveted (and for most collectors unattainable) banknote had already been sold. Photo: Kagin’s

What is special about this offer is the combination of a physically existing, historically significant collector’s item with modern technologies such as NFTs (Non-Fungible Tokens) and blockchain. Unlike purely digital collectibles, buyers here receive a genuine ownership share in a physical object of museum quality, which has been regarded as a true icon in US numismatics for nearly a century. It is placed alongside other numismatic legends such as the 1804 Silver Dollar or the 1907 Ultra High Relief Double Eagle.

Fractional Ownership: An Odd Business Model?

The concept of fractional ownership – that is, shared ownership of a high-value asset – is originally known from the aviation and real estate industries. For example, several parties can jointly own a private jet or a holiday property, sharing usage costs and investments. In recent years, fractional ownership has also extended to collectibles such as artworks, classic cars, luxury watches, or sports memorabilia. Furthermore, there are already initial efforts within numismatics to use blockchain technology to securely and transparently manage proof of ownership.

The Legal Framework

From a legal perspective, offers involving the purchase of shares in collectibles often do not grant direct ownership of a physical part of the item. Instead, buyers acquire a share in a special purpose vehicle or a trust model that owns the object. In blockchain-based models, the share is documented via an NFT (Non-Fungible Token), which may symbolise voting rights or participation rights in future sales profits. Physical access to the object itself is generally not granted. The exact legal structure depends on the respective provider and the legislation of the provider’s home country and should be reviewed in each individual case.

Advantages and Disadvantages of Fractional Ownerships

The model of fractional ownership opens access to high-value and exclusive investment objects to a broader group of buyers who would otherwise be restricted to very wealthy collectors. The risks and costs of acquisition and maintenance are divided among several owners. In blockchain-based models, buyers also benefit from a transparent, tamper-proof documentation of their shares. The resale of individual shares can be more flexible than selling an entire object.

However, purchasing shares via fractional ownerships also involves risks: since the shareholder usually has no direct physical access to the object, there is a certain dependency on the provider regarding storage, care, and insurance of the collectible. In addition, the liquidity and resale value of such shares are often unclear and can fluctuate significantly. Legal uncertainties, for example in the event of the provider’s insolvency, may present additional risks. Investors should therefore thoroughly inform themselves about the contractual terms and the reliability of the respective offer.