A Year of Gold Bars in US Supermarkets: Could the Costco Model Work in Europe?

By Sebastian Wieschowski

In a supermarket, a customer strolls through the aisles, filling her trolley with everyday products such as bread, milk, and household goods. Suddenly, she stops in front of a special shelf: alongside electronic devices and jewellery lie gold bars – real 24-carat gold bars, vacuum-sealed and securely packaged. With a quick glance at the price tag, she picks one up, scans it like any other product at the checkout, pays, and leaves the store – a scene that has become a reality in the US since autumn 2023, when the wholesaler “Costco” began offering investment gold bars.

Content

Hundreds of Millions in Monthly Revenue

In Germany, however, such a purchase is still unimaginable. Here, gold bars are considered exclusive products that can only be bought in specialised shops, banks, or from precious metal dealers. When Costco in the US started offering gold bars in its stores in September 2023, it caused a stir internationally and sparked discussions. However, the model has proven to be a huge success in the US: as soon as new stock arrived, the gold bars sold out within a short time, with the wholesale chain reportedly generating monthly revenues of between 100 and 200 million US dollars – and Costco members can still make this unique investment while doing their weekly shopping.

However, this success is based on a number of factors that cannot easily be transferred to Europe or, more specifically, Germany. For one, Costco in the US is a phenomenon that does not exist in the same form in Europe. The company offers its customers wholesale-format products at wholesale prices, and many Americans hold a paid Costco membership to take advantage of these favourable conditions.

Costco is Unique in the US Retail Landscape

A comparable retail model is rarely seen in Europe – there are some wholesale chains, but none that match the reach and popularity of Costco in the US. And to achieve gold sales of several hundred million euros a month, a certain company size is required – especially since “revenue” in the precious metal trade does not equate to “profit.” The margin for classic investment products like gold bars is in the low percentage range.

Another difference lies in the infrastructure of the precious metal trade. While in the US, many people can only buy gold online or in selected shops, in Germany, almost every major city has one or more specialised precious metal dealers offering gold in various forms. These shops enjoy the trust of their customers, offer advice, and hold a firm place in the German retail structure. As a result, the need to buy gold in supermarkets is less pronounced here than in the US.

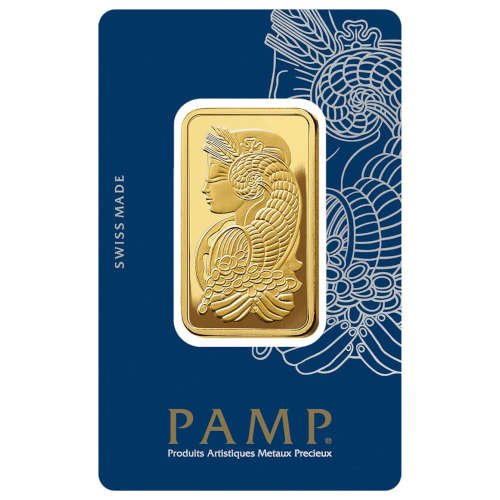

The coveted item for many Costco customers: a Fortuna gold bar from the Swiss refinery “Pamp.” Photo credit: Costco/PAMP.

Picking Up Precious Metals While Shopping – A Long-Established Standard in Germany

Another factor arguing against simply transferring the Costco model to Germany is the cultural understanding of gold as an investment. In Germany, buying gold is often seen as a long-term, strategic decision. Many investors value personal contact with a dealer who provides them with security and trust.

The spontaneous purchase of a gold bar during the weekly shop would go against the German investment mindset, where finding the best price is often accompanied by extensive research and consideration – and where much of the population continues to avoid tangible asset investments like precious metals or even stocks, preferring instead to keep their money in savings accounts.

Large Volumes, Small Margins – Which Discounters Would Be Interested in This Business?

But could it still be possible to sell gold through retail in Germany? A model where large retailers, in collaboration with precious metal dealers, offer small amounts of gold, perhaps in the form of coins or small bars, is conceivable – how about an Aldi bar, for instance? These could be displayed in secure cabinets in stores, much like consumer electronics are already sold in discount stores. The issue here: discounters have high margin expectations.

The only realistic possibility at present would likely be offering precious metal products through the online platforms of major retailers, with delivery handled by the dealers. This way, the supermarket could act as an intermediary without having to dive into the complex precious metal trade itself. Exclusive partnerships between well-known retail chains and established gold dealers could also boost customer confidence and simplify access to gold.

Impressive Returns for Costco Customers

While German investors may still have to visit their nearest precious metal dealer for now, Costco customers who bought a gold bar on a whim in September 2023 have reason to be pleased: the gold price has risen significantly over the past twelve months. Anyone who purchased a gold bar for around $1,950 per ounce back then can now enjoy a value increase, as the gold price in September 2024 is approximately $2,600 per ounce. This represents an increase of a third in just one year – a satisfying return for anyone who invested in the precious metal at the right time.