An Active Industry Comes Together at The Coin Conference 2024

A review by Coin & Mint News

The Coin Conference 2024 took place in Lisbon, Portugal’s capital, situated on the River Tagus and one of the oldest cities in the world. Taking place 28-30 October, Lisbon’s combination of the historic and modern was the perfect location for an event focused on the future of circulating coinage and its challenges.

Content

The conference hosted more than 200 delegates, from 102 organisations across 42 countries, with 40% from central banks, monetary authorities and treasury departments.

What Should Coin Issuers Focus On?

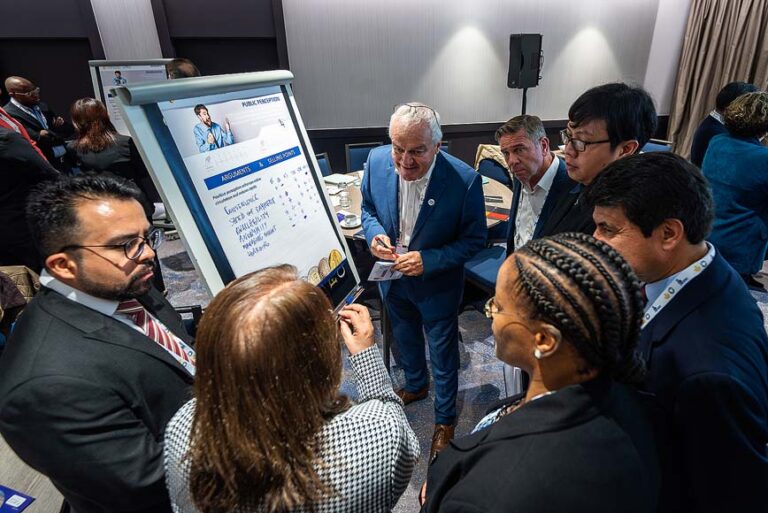

Two workshops opened the conference, with the first ‘That was Then, This is Now – the New Priorities for Coin Issuers’ attended by central banks and coin issuers. Led by Dieter Merkle of Schuler, the workshop focused on the work of the Customer Task Force under the auspices of the International Mint Industry Association (IMIA). Seven key coin attributes – attractiveness, innovation, obligation, public perception, security, seigniorage (cost/profit), and trust – were noted as priorities for those involved in the coin cycle to focus on.

The second workshop concentrated on ‘Commemorative Coins for an International and a Domestic Market’. Led by Ursula Kampmann of FAMA and CoinsWeekly, and supported by Falk Liebnitzky of CIT Coin Invest, the workshop detailed why a nation should issue commemorative coins, players in the coin market and their interests, and covered political concerns versus saleability. Participants took part in group work to create their own commemorative coin series, learning about the factors involved in the creation of a successful coin release including minting and design techniques.

Setting The Scene and Varying Perspectives

The main conference programme was opened the following day by Helena Adegas, member of the Board of Directors of Banco de Portugal, with an overview of the cash and coin landscape in Portugal and the eurosystem. This was followed by a more general overview of the circulating coin landscape by Astrid Mitchell of Currency Publications, including key factors driving or slowing coin circulation over the last five years.

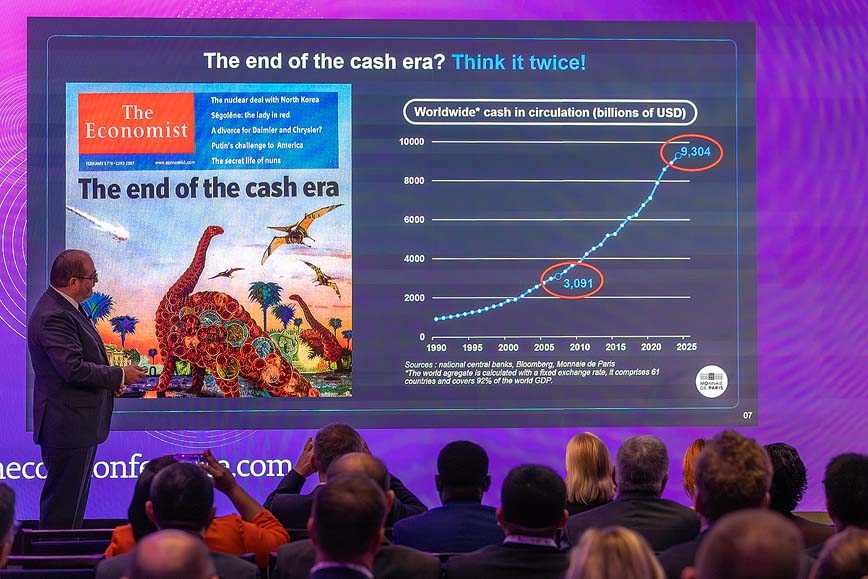

Session 1 continued to focus on ‘Setting the Scene – Cash and Coins’ with presentations from Monnaie de Paris (MdP)’s Marc Schwartz on cash, cryptos, CBDCs, and the question of ‘what is money’ and the European Commission’s Irina Stoicescu on the organisation’s perspective on euro coin issuance and protection and the legal tender of euro cash. The IMIA’s Martina Horakova closed the first session’s presentations by detailing its analysis of European legislation and proposals in favour of cash access and acceptance.

Sessions 2 and 3 focused on coin circulation from the issuer and market perspectives, respectively. Delegates heard from the Federal Reserve Financial Services – FedCash Services’ Turner Angell on issues with US coin circulation and from Banco de Portugal’s Rui Manuel Monteiro and the Economic and Financial Committee’s Antra Trenko on coin circulation in the eurozone. Rosabel B Gurrero and Marie Lemay detailed the Bangko Sentral ng Pilipinas (BSP) and Royal Canadian Mint (RCM)’s approaches to ensure efficient coin circulation, including the BSP’s coin deposit machines and RCM’s coin management system.

The market perspective included presentations from Crane Payment Innovations’ Keith Williamson and Brink’s Anne Richard Schaafsma on improving coin circulation and from Global Coin Solutions’ Scott Hutchings and Leftover Currency’s Mario Van Poppel on coin repatriation. Proditec’s Eric Sanquer closed the session with an insight into the potential use for robotics and AI in coin recirculation.

The final session of the day focused on sustainability. Currency Publications’ John Winchcombe opened the session with a review of the environmental impact of friction in coin circulation. This was followed by the presentation of a continuing research study by the Mint Directors Working Group’s Pascal Rencker, focusing on the sustainability of cash vs digital payments and conducted in partnership with the International Currency Association.

The topic was continued with a focus on unfit coin and recycling. Arrandene’s Simon Billingham provided examples of coin recycling to optimise sustainability and financial outcomes, M.One’s Daniel Sheffer emphasised responsibility in decoining operations, and the Austrian Mint’s Claus Fischer detailed the withdrawal of mutilated and unfit coins from circulation according to Austrian and EU regulations.

The session was followed by presentation of the IACA Excellence in Currency Awards for Coins, with those awarded as follows:

- Best New Commemorative/Limited Circulation Coin: Central Bank of The Bahamas for its 25 cent coloured coin released to celebrate its 50th anniversary

- Best New Coin Product, Process or Manufacturing Innovation: Royal Canadian Mint for its environmentally friendly bronze plating process for circulation coins that eliminates the use of toxic chemicals

- Best Recirculation/Distribution Initiative or Innovation: awarded jointly to Bangko Sentral ng Pilipinas for its Coin Recirculation Program and the Central Bank of Eswatini for its Coin Management Efficiencies Project.

Production, Inspection, Authentication, and Innovation

Wednesday morning opened with two sessions focusing on production, inspection, authentication, and innovation. Mennica Polska’s Siemowit Kalukiewicz and Łukasz Karda began session 5 by detailing their latest innovation, a flying coin, followed by Imprensa Nacional Casa da Moeda (INCM)’s Bruno Patrão introducing the Mint’s UniqueMark® hallmarking technique for precious metals. A world premiere of ACSYS Lasertechnik’s Ultra Short Pulse Technology, offering a roughing and finishing process strategy with laser technology, was then launched by Alexander Aminidis. The session concluded with Schuler’s Dieter Merkle detailing the advantages of combined minting and digital solutions, including cost reduction, process improvement, and continuous improvement.

Spaleck’s Ingo Loeken then took delegates through all round inspection using optical validation technology, IQ Structures’ Robert Dvorak detailed the possibilities of integrating holograms into coins, and Carveco’s Robert Newman explored the potential of artificial intelligence for coin design and analysis, merging traditional craftmanship with new technology. Inorcoat’s Romain Waidelich closed the session with the presentation of a new process to de-coat chromium-coated circulation dies and subsequently re-coat them with a PVD coating.

The final session of the conference took delegates on a global trip of coin circulation. FMA Secure’s Francisco Mandiola presented on coin usage in countries with high inflation, such as Argentina, India, USA, Mexico, Venezuela and Zimbabwe. Aftab Baloch, formerly of Pakistan’s Ministry of Finance and Federal Board of Revenue, expanded on the country’s coin distribution process, noting the impact of digital payments and modernisation requirements for Pakistan’s Mint.

Fabrica Nacional de Moneda y Timbre – Real Casa de la Moneda (FNMT)’s José Luis Orozco then discussed the Spanish Mint’s collaborations with other mints and issuing authorities, including INCM, the Royal Australian Mint, the Europa programme, and the recent XIII Iberian-American Series. This was followed by the Central Bank of Eswatini’s Zodwa Nkambule detailing its Coin Management Efficiencies Project (for which it won an award, see above), resulting in an estimated E14 million in cost savings since the inception of the project. RCM’s Marie Lemay ended the conference presentations by introducing the new Mint Directors Association, including its ethos, 18 member mints and 8 associate members, and upcoming new virtual hub.

Looking to the Future

A panel discussion titled ‘Coins in 2035 – What Will the Industry Look Like’ brought the conference to a close by considering the future of the industry. Led by Simon Lake, formerly of The Royal Mint and now Senior Advisor to the Board of Mennica Polska, the panel included the RCM’s Marie Lemay, Mennica Polska’s Siemowit Kalukiewicz, Royal Australian Mint’s Leigh Gordon, MdP’s Nicolas Dumont, and the Thai Treasury Department’s Prapop Anantakoon. Topics included recent changes (including The Royal Mint’s transformation and complete closure of the Mint of Finland), diversification of mints (opportunities available and programmes already in place), denominational structure including the impact of negative seigniorage and considerations of the note-coin boundary, the changing role of coins amidst digital payment transformations, and how mints will continue to meet the challenges of ensuring efficient coin production and circulation.

The M One Cup Football Match then concluded the conference social events and was greatly enjoyed by all participants.

The next Coin Conference will take place in 2026, with the location to be announced in due course.

This article by Coin & Mint News was originally published on the Coin Conference website.