The Monetary History of the USA, Part 5: The 70s and 80s

The political crisis of the United States continued during the 70s. After the Watergate scandal shocking the nation, only President Reagan was able to restore the confidence of the USA – especially by means of his economic policies.

The 1-dollar coin had not been minted since 1935. Since then, there had been several attempts to re-start the minting of dollars, but none of them was really successful. At the end of the 60s, however, the American nation was torn apart and in desperate need of a new identification symbol. Therefore, Congress proposed to create a new dollar. On the obverse it featured the portrait of recently deceased former President and war hero Dwight D. Eisenhower. The reverse recalled the pride of the American nation: the flight of Apollo XI, the first space flight that landed man on the moon in 1969.

The new circulation dollar was made of clad. However, 150 million dollars were made of clad silver for collection purposes – a complex mixture consisting of 80 percent of silver and 20 percent of copper on the outer layer of the coin, whereas the core was made of 80 percent of copper and 20 percent of silver. These coins were issued from 1971 on.

The Policy of Relaxing Tensions During the Cold War

In the first half of 1972, the travel enthusiasm of American President Richard M. Nixon (1972–1974) gained attention all over the world: In February, he was the first US President to visit the People’s Republic of China. Less than three months later, Nixon travelled to the Soviet Union – another premiere. The president collaborated closely with his National Security Advisor Henry A. Kissinger (*1923) – a great admirer of Bismarck. And just as his role model, Kissinger acted as a clever strategist and a brilliant foreign policymaker, too.

Together, Nixon and Kissinger developed the concept of a policy of détente based on an equilibrium of the three world powers – the United States, the Union of Soviet Socialist Republics (USSR) and China. Obviously, there were concrete, practical reasons for the sudden abandonment of strict anti-communism: It was no longer possible for the USA to win the war in Vietnam – but there was no end in sight either. The USSR had caught up in terms of armament and even seemed to be outpacing the Unites States. Furthermore, there were tensions between China and the USSR – not only the USA, but the People’s Republic, too, had an interest in mutual relationships. But as the relation between the superpowers relaxed, tensions increased in other parts of the world.

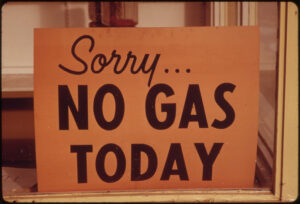

Sorry, No Gas Today

In the winter of 1973/74, the Arab states controlling the oil resources taught the West to fear: The Organization of the Petroleum Exporting Countries, OPEC, imposed an oil embargo against the USA and other developed countries – the reason was their “Israel-friendly” attitude during the Yom Kippur War (1973) between Israel, Egypt and Syria. Western politicians feared a tremendous crisis. Economists believed this would be the end of growth and prosperity.

Even though the oil soon started to flow again, the West was hardly hit by the recession provoked by the oil crisis. Additionally, the United States had to face an inflation caused by the war in Vietnam and high unemployment. But it wasn’t only economic uncertainty that made the following years a difficult time for the American people.

Watergate

In 1974, the American nation suffered a severe national crisis. An entire series of revelations unearthed the terrifying dimensions of corruption and criminality within the highest – the very highest – circles of government. The Watergate scandal, the reason why President Nixon had to resign from office, was only the tip of the iceberg. However, it escalated into an alarming internal crisis and resulted in a huge loss of trust within the political class of the United States. Furthermore, it destroyed the almost religiously exaggerated myth of US Presidency – for which, obviously, already long before Nixon there had no longer been any reason.

Stagflation

The confidence of the United States was still suffering from the Vietnam War and from the Watergate scandal when another fiasco occurred in 1979: In Tehran, the capital of Iran, college students took over the US Embassy and held the employees of the Embassy hostage; a rescue mission of the United States failed. This caused US President James E. Carter (1977–1980) to establish a new record in terms of unpopularity. A revolution broke out in Iran cumulating in the overthrow of the Shah and the beginning of the war with Iraq. This resulted in a second oil crisis. Once again, the world slid into an economic crisis.

In addition to the oil price shock, conservative economists also blamed the economic policies of the Western world for the recession. Their diagnosis: By intervening too much in the economy, the governments of developed countries pushed up taxes and caused chronic budget deficits. Higher taxes slowed down consumption, while increased borrowings of governments pushed up interest rates. This resulted in an increased cost of capital, which, in turn, reduced the willingness to invest. And there can’t be growth without investment. Moreover, they said, exaggerated wage demands of trade unions led to a significant increase in prices. The result: stagflation – a combination of stagnant economic growth and inflation.

Reaganomics

This was the moment when Hollywood actor Ronald W. Reagan entered the stage of world politics. Promising new strength and greatness for the nation and demanding internal reforms, he was elected President of the United States (1981–1988). Reagan actually succeeded in restoring the damaged national confidence within a very short amount of time – especially due to his economic and social policies, which were later to be referred to as Reaganomics. Like British Prime Minister Margret Thatcher, Reagan agreed with conservative economists, he cut taxes drastically and promoted the state’s withdrawal from most areas of economic life. Moreover, Reagan significantly increased the expenditure on armaments and cut social services.

Thanks to Reaganomics, the United States experienced a considerable economic growth in the 80s. The greatest share price boom of the 20th century begins – and with it the steep rise of the dollar: In the middle of the 80s, the dollar’s value had left all other important currencies far behind. In 1985, however, the United States, the United Kingdom, Germany, France and Japan agreed on measures to stabilize the dollar by means of the so-called Plaza Accord. In the next two years, the American currency depreciated by 30 percent, a 10-year long slump followed. And yet, many Asian countries – China in particular – invested most of their national savings in USD. Thus, they did not only accept the dominance of the American currency, but also strengthened the position of the USD as anchor currency of the foreseeable future.

The Small Change Was Too Big

After re-starting the minting of dollar coins in 1971, the tradition was continued – not least because metal money can obviously be used for a much longer period of time than paper money. However, the large and heavy coins were extremely unpopular among US citizens and didn’t circulate well. That is why the Eisenhower dollar was replaced in 1979 by so-called mini dollars, which were significantly smaller and lighter than their predecessors.

This dollar has been valid in the United States since January 2000. On the obverse it depicts Lemhi Shoshone woman Sacagawea, who played an important role for the success of the expedition of Lewis and Clark at the beginning of the 19th century: These two men hat set out in 1804 to discover a route between the Mississippi River and the Pacific coast – a 12,300 km journey through unexplored Indian territory. The fact that they returned safe and sound was, as mentioned, due to the careful guidance of 15-year-old Sacagawea, who also gave birth to a son on the journey, whom she carried on her back – as shown on the coin – to the Pacific coast and back again.

There are only a few of such dollar coins in circulation today; they are mainly used in casinos and for vending machines. Right now, the dollar has a low purchasing power anyway – you don’t even get a loaf of bread for one dollar.

You can find all parts of the series here.