Numindex Update: Prices for Mid-Grade Coins Are on the Rise

by Michael M. Zagorowski

The latest update of the coin price index numindex shows a 20% increase over the last 6 weeks. This confirms what dealers and collectors have been noticing lately: prices for medium quality coins are also rising significantly. Michael Zagorowski tells us about the underlying causes and about recent observations in the trade and at coin shows.

Content

Coins as an Investment

Gold is traditionally seen as a safe haven during a crisis – it survived wars, depressions and currency reforms. In times of economic uncertainty or inflation, precious metals maintain or even increase in value, making them a popular hedging strategy. When stock markets collapse or paper money loses value, precious metals act as a stabilising element, reducing the overall risk of an investment.

Unlike other forms of investment such as shares or bonds, gold and silver coins offer the advantage of physical ownership. And the fact that the price of gold has risen massively in recent months has not gone unnoticed. The Swiss newspaper Neue Zürcher Zeitung (NZZ) recently ran the headline: “The price of a Vreneli has multiplied, and the coin costs more than ever before”.

The Value of Coins

Coin collectors will inevitably wonder at some point or another how the value of the coins they collected over decades has changed over time. Did the value of their collection increase?

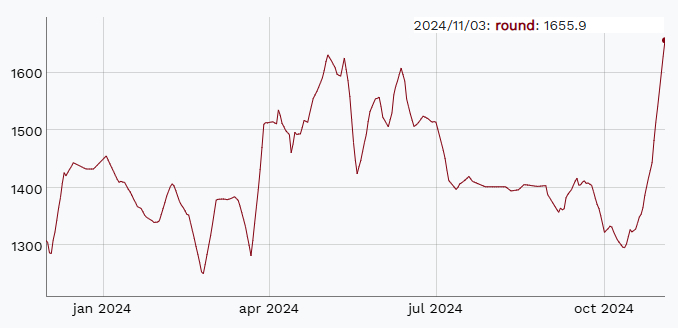

One possible answer can be found in the update of the numismatic index numindex, published at the beginning of the month. Similar to a stock market index, numindex measures coin prices and presents them graphically for the past and the present. While the index hovered around 1,400 points in recent months, it has risen to over 1,650 points in the last few weeks. This corresponds to an increase of almost 20% this year alone.

The Reasons

On the one hand, the increase is related to the rise in precious metal prices. But there was also another aspect that stood out in recent auction sales: not only coins in the best condition were fetching top prices, but coins of average quality were also reaching new highs. The fact that very little “new stock” is coming back on the market seems to be confirmed by the prices achieved. Collectors are keen to acquire something new, and when no top pieces are available, they are prepared to buy the second best quality.

Voices from the Zurich Coin Fair

Feedback from visitors to the Zurich Coin Fair at the end of October confirms this impression. Several dealers expressed their delight that collectors are finally willing to buy mid-grade coins again, and no longer want to wait until the best-preserved piece can be purchased.

Conversely, collectors have expressed regret that dealers are offering little or no discount, arguing that the coins are trading at exactly this price in the secondary market and will otherwise realise their value at auction, albeit at a premium, making it cheaper for the collector to buy the coin at a coin fair. Ultimately, most collectors chose to go through with their coin purchase, gritting their teeth but happy in the end.